In the late 2000s, copy trading developed when online trading platforms permitted investors to copy the trading activities of skilled traders. Retail traders used to depend on manual signals and advisory services which charged hidden or obscure fees. The development of copy trading into automated systems led researchers to study both performance data and actual expenses linked to each trade.

People today can use contemporary copy trading applications and copy trading software to track leading traders through a single button push. Most users still do not grasp the actual costs they incur for each trade. Copy trading establishes its cost structure through multiple fees which replace the standard single fee used by traditional broking systems. Traders need to understand these expenses because they affect both their risk management and their ability to select successful copy trading strategies.

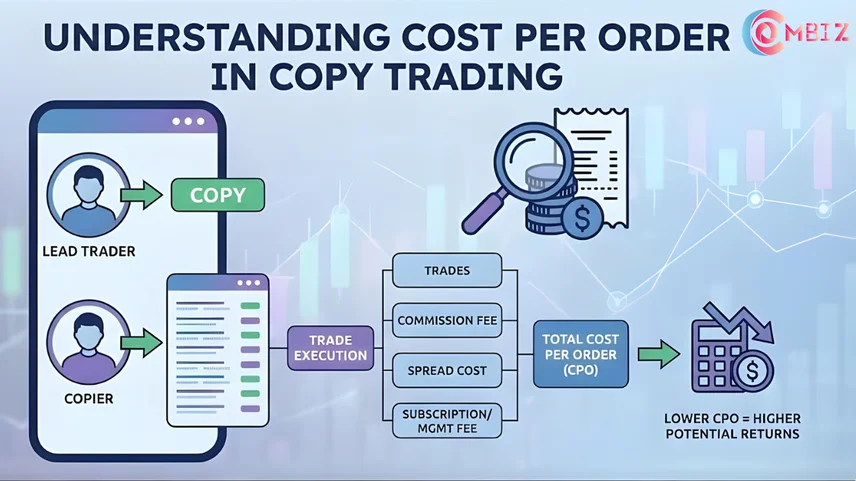

The term 'cost per order' in copy trading refers to all expenses associated with executing a copied trade in your trading account. The cost of your trade changes based on three factors: the trader you select, the trading platform you choose and the current market conditions.

Copy trading requires users to pay multiple fees, which include performance-based charges and platform costs and execution expenses, while manual trading only requires users to pay broking fees or commissions. Your actual profit from the investment will be determined by these factors.

1. Performance Fees

2. Spreads and Commissions

The spread defines the price difference between the asset's buy (ask) price and its sell (bid) price. Some platforms also charge direct commissions per trade.

Key points:

3. Swaps / Overnight Fees

The system charges swap or rollover fees when traders keep copied positions active during the night.

The fees depend on

Long-term copy trading strategies experience substantial impact from swap fees, which reduce their overall returns.

4. Slippage

Slippage happens when your copied trade execution price differs from your expected price because of market volatility.

Reasons include:

Advanced platforms like Combiz focus on fast execution and smart order handling to minimise slippage, protecting followers from unnecessary losses.

Not a Flat Fee

Copy trading lacks a standard fixed cost for each trade. The costs will change according to these factors:

The tracking process needs constant monitoring because costs need to be verified instead of using a pre-established fixed rate.

Platform-Dependent Fee Models

Different copy trading platforms structure fees differently:

A professional copy trading application must display actual net profit after deducting all expenses.

The profitability of a trading strategy decreases when traders overlook the associated trading expenses. The smart copy traders of this system treat their trading expenses as elements which they must handle through their risk assessment process.

1. Transparency Is Key

The copy trading software selection process requires users to select software which provides them with:

Combiz operates as a platform which enables users to see their actual order costs through its transparent system that shows them costs before and after order execution.

2. Diversify Your Copy Trading Portfolio

Instead of copying a single trader:

Diversification helps balance both risk and cost impact.

3. Use Stop-Loss and Risk Limits

The implementation of risk controls needs to follow these exact rules:

The controls establish loss limits which remain active during periods of market instability when prices increase.

4. Analyse Trader Metrics Carefully

Traders should not receive their complete assessment based on their ability to generate high profits. The assessment should emphasise these three aspects:

The combination of reduced drawdown and consistent performance leads to decreased total operating expenses for the business.

The ideal copy trading platform should include:

Newer types of copying platforms like Combiz will help traders make decisions based on data through the use of an automated tool that combines transparency, smart principles, and risk management.

The cost per order in copy trading is not just one fee—it is a combination of performance fees, platform charges, spreads, swaps, and execution costs. The traders who understand these elements will gain better skills to manage their risk while safeguarding their long-term profits.

The traders who use transparent platforms and multiple trading strategies while implementing strict risk control measures can develop copy trading into an intelligent and durable investment strategy.

In copy trading, profits matter—but knowing your costs matters even more.